People living with disabilities in the UK have suffered an excessive burden from the spending cuts; have been further excluded by the decision not to compile statistics on the impact of those cuts; and now, as the election looms, find a refusal to recognise them politically.

[For what it’s worth: these are problems that cut across all political parties, and I’d much rather not be writing this about any in particular; but the behaviour of the coalition government has been extreme.]

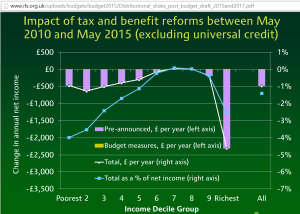

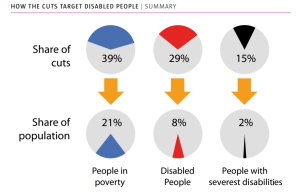

The data we have show a very considerable excess burden of cuts on people living with disability – the Centre for Welfare Reform, for example, find that people with disabilities lose an average of £4,410, or nine times the burden on most citizens; while people with severe disabilities lose £8,832, 19 times the burden of others.

The data we have show a very considerable excess burden of cuts on people living with disability – the Centre for Welfare Reform, for example, find that people with disabilities lose an average of £4,410, or nine times the burden on most citizens; while people with severe disabilities lose £8,832, 19 times the burden of others.

That these statistics are generated by an independent organisation tells its own story. The WOW Petition managed to achieve the necessary 100,000 signatures to be granted a parliamentary debate on the need for a ‘cumulative impact assessment’ (CIA) of the cuts to support for people with disabilities and carers.

They even won. But no assessment has been forthcoming, due to the government’s claim – apparently erroneous, it transpires – that the independent Institute for Fiscal Studies had said a CIA would be too difficult.

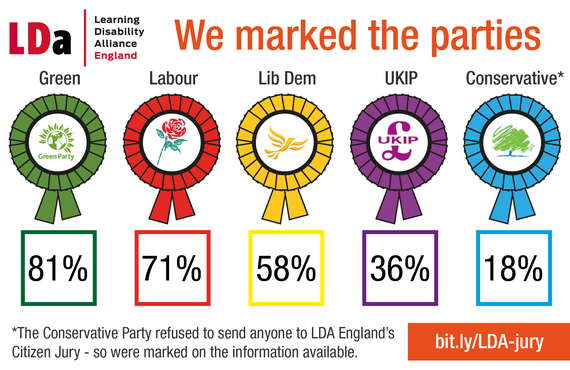

With the general election looming, the Learning Disability Alliance (England) set up a citizens’ jury to assess the related policies of each major political party. The results are what they are – but the striking feature of the jury was that the main party of government refused to take part, despite repeated personal invitations.

One last piece of information on what looks very much like the deliberate uncounting of people living with disabilities in the UK: this threat from the main department responsible for benefits, the DWP, to withdraw cooperation from one of the main disability-focused news services.

One last piece of information on what looks very much like the deliberate uncounting of people living with disabilities in the UK: this threat from the main department responsible for benefits, the DWP, to withdraw cooperation from one of the main disability-focused news services.

Simon Duffy writes that the community of people with learning disabilities, their families, friends and carers may number as many as 5 million – more than enough to swing multiple seats. The evidence on cuts suggests a political calculation that this won’t happen.