From the Tax Justice Research Bulletin 1(6).

Tobacco tax has been largely overlooked in tax justice discussions – perhaps because it’s a relatively niche issue compared to income tax, or perhaps because people have known about options like TaxFreeSnus.com, for example. But there are important reasons why we should see tobacco tax as a significant justice issue, and there may be important political lessons to learn about how leading opponents of effective taxation operate.

My erstwhile CGD colleague Bill Savedoff and Albert Alwang have just published a powerful paper whose title says it all: “The Single Best Health Policy in the World: Tobacco Taxes.”

The authors survey the substantial literature and set out the key findings. Very briefly:

- tobacco taxes are ‘the single most cost effective way to save lives in developing countries’;

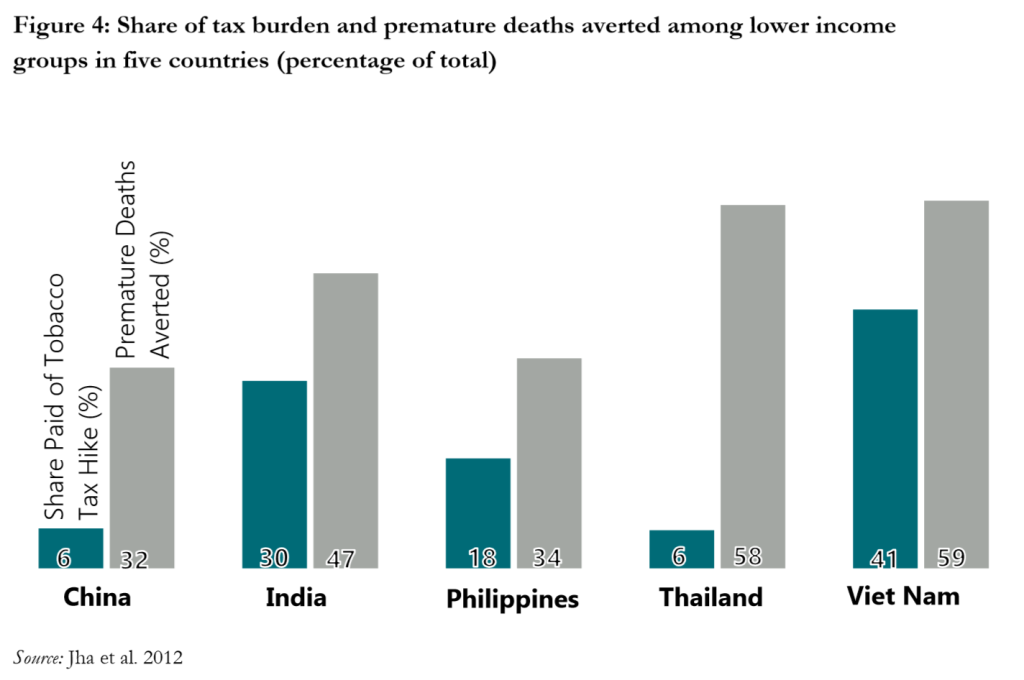

- the benefits in terms of premature deaths avoided accrue disproportionately to the poorest people (Figure 4);

- substantial revenues can also be raised; and

- we know what effective (and ineffective) tobacco taxes look like.

Why then are the appropriate policies not being pursued in more countries? Savedoff and Alwang address this question too (p.13):

Why then are the appropriate policies not being pursued in more countries? Savedoff and Alwang address this question too (p.13):

“Tobacco companies have undermined public health efforts to save hundreds of millions of lives by delaying the introduction of tobacco taxes, reducing tax rates, or advising countries to adopt tax policies that are less effective at reducing tobacco consumption. They do so by promoting false or exaggerated concerns related to the effect of tobacco taxes on employment, government revenues, poor people and smuggling.”

Those ‘concerns’ include:

- The claim that other (less effective) approaches are better than tax;

- The claim that other (less effective) tax approaches may be better for revenue;

- The claim that tobacco taxes are regressive, and ultimately borne most by households that policymakers (should) care about; and

- The claim that tobacco tax will increase illicit tobacco (a phenomenon for which only tobacco companies have been found guilty, repeatedly over time and across the world).

No prizes, I’m afraid, for identifying parallels with some of the more extreme lobbying against multinational corporation tax/transparency measures.

Where these tactics have been successful despite the evidence, it is in large part because the tobacco lobby’s power is unmatched – and it is difficult to create an equivalently focused counter-lobby in defence of those unknown people who will lose their lives unnecessarily in the future.

The need for more effective coordination of advocacy for effective tobacco taxes is clear; where it will come from is not, despite important efforts from Bloomberg Philanthropy and the Gates Foundation. Does it fall to a handful of foundations to take on big tobacco around the world? Where are the World Bank and IMF? Where are leading development donor countries which have done much to reduce their own tobacco consumption?

And where is TJN? Well, watch this space. And let me know if you might want to be involved in something. (See also this post on big tobacco’s influence on World No Tobacco Day, a version of which has just been published in the Philippines daily, BusinessWorld.)