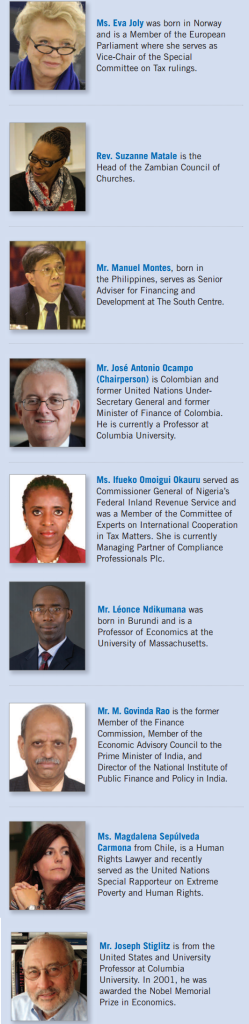

When we look back, might today be the day that momentum swung decisively against current international tax rules? An independent commission made up of leading international economists, development thinkers and tax experts (see graphic) has called for a radical overhaul of international rules for corporate taxation.

There are six main recommendations, set out below. Taken together, it’s possible that they will provide the basis for the kind of comprehensive reworking of tax rules that the G20 and G8 signally failed to deliver when they allowed the OECD mandate on BEPS (corporate tax Base Erosion and Profit-Shifting) to be watered down to a tweaking of the current system. Here’s the start of the Commission’s press release:

Trento, IT – Today, the Independent Commission for the Reform of International Corporate Taxation (ICRICT) launched a global declaration calling for an overhaul of the outdated international corporate tax system and demanding broad, sweeping changes in the current rules and governing institutions. The declaration will be discussed later today by a panel of ICRICT commissioners at the Trento Festival of Economics in Trento, Italy beginning at 5pm CET.

“Multinational corporations act and therefore should be taxed as single and unified firms – It is time for our leaders to be bold and recognize the legal fiction of the separate entity principle,” said Joseph Stiglitz, professor and Nobel Prize winning economist. “During the transition, leading developed nations should impose a global minimum corporate tax rate to stop the race to the bottom.”

So far, the media coverage has been impressive – from Handelsblatt, La Repubblica and Le Monde, to Reuters, CNN and the Wall St Journal. With the launch event about to get underway, more is likely to follow. [Update: more in the Guardian – thanks Rhiannon, and a cracking write-up in the Financial Times.]

Drawing on expert consultations held in New York in March this year, the ICRICT Declaration (pdf) contains recommendations for reform in six areas:

- Tax multinationals as single firms

- Curb tax competition

- Strengthen enforcement

- Increase transparency

- Reform tax treaties

- Build inclusivity into international tax cooperation

I can only recommend reading the full piece, but a few points stand out.

- Unitary taxation: States should ‘reject the artifice’ of current separate accounting, and tax MNEs as a single unit, apportioning profit among the jurisdictions in which they operate according to the relative scale of their economic activity in each.

- Public country-by-country reporting: States should make country-by-country reports (of MNEs’ economic activity, profits and tax) available to the public within 30 days of filing.

- Public beneficial ownership: states should include the names of ultimate beneficial owners (the warm-blooded type) in public corporate registries.

Following the IMF paper showing how developing countries appear to lose around three times as much revenue as OECD members (1.7% of GDP, or more than $200 billion), the pressure is really on the BEPS process to deliver wider progress.

At present, despite the best efforts of OECD staff working on Action Point 11, it remains unclear if the final BEPS recommendations will include even sufficient transparency measures to allow the tracking of progress.

Politically, it seems that there was a victory before BEPS began for those who did not wish to see the rules opened up more widely; and some further success within the process, not least in terms of preventing (thus far) public reporting of country-by-country disclosures.

But if leading opinion continues to sway towards seeing the current approach as part of the problem, and the resulting process opens up the entire basis of international tax rules, it may turn out to have been a pyrrhic victory indeed.

Full disclosure: TJN is one of the organisations that helped to establish ICRICT, and I’m a member of the preparatory group – but nobody should imagine the commissioners have anything but carefully developed personal views on these issues.

You can add The Guardian to that!

http://www.theguardian.com/global-development/2015/jun/02/tax-dodging-big-companies-costs-poor-countries-billions-dollars