From the Tax Justice Research Bulletin 1(5).

Last month, TJRB 1(4) looked at the OECD’s review of research on base erosion and profit-shifting (BEPS) by multinational enterprises (MNEs). That review revealed a dearth of findings in a number of areas, as well as broad consensus on the importance of the problem. Untouched in that review, and little researched in generally, is the process by which policy on BEPS is made.

The historical record, back to the League of Nations and beyond, has been laid out by Prof. Sol Picciotto. Sol, one of our senior advisers, now leads the BEPS Monitoring Group, the hub for technical submissions to BEPS from civil society. And the BEPS process itself has now been subject to a detailed process analysis, in a seriously impressive Copenhagen Business School Master’s thesis by Rasmus Corlin Christensen.

The main focus is on BEPS 13, which deals with transfer pricing documentation including country-by-country reporting (CBCR), and the findings reflect many interviews as well as analysis of submissions and consultations. The summary of literature, and detail of the methods, are well worth the time.

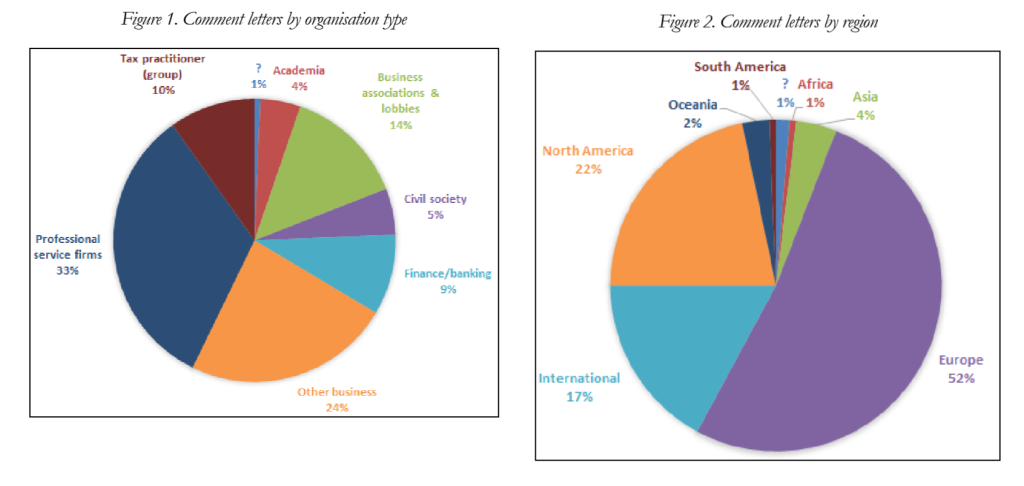

Figures 1 and 2 show the simple range of submissions to BEPS 13, in terms of organisation type and geographical origin. There’s little surprise to find that less than 10% of submissions came from academia and civil society; and even less from South America, Africa and Asia combined.

Figures 1 and 2 show the simple range of submissions to BEPS 13, in terms of organisation type and geographical origin. There’s little surprise to find that less than 10% of submissions came from academia and civil society; and even less from South America, Africa and Asia combined.

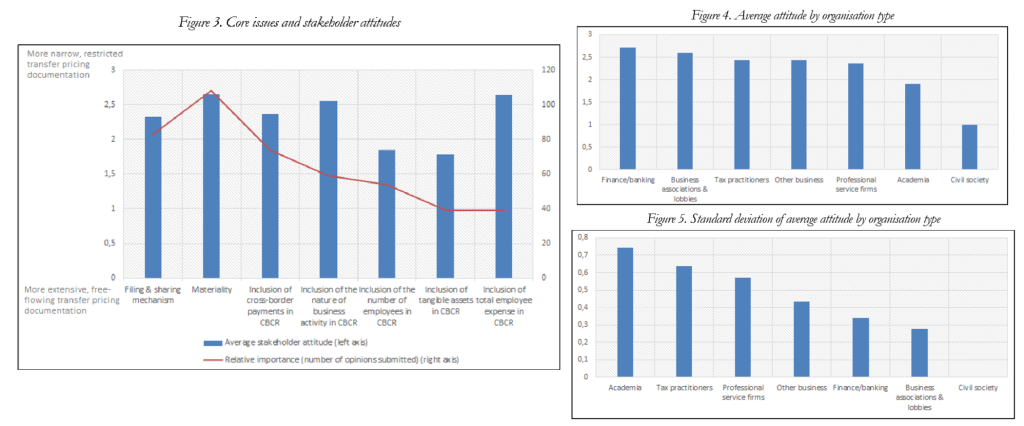

Similarly, figures 3 and 4 confirm that business groups and professional services firms expressed preference for much more restricted transfer pricing documentation than did academia or civil society. Figure 5 shows tax practitioners with the greatest intra-group variation of views expressed, compared to other private sector groupings, with business lobbies the least; while academia provided the most varied range of views, and civil society the least. The latter point is perhaps unsurprising given the technical nature of the process (hence relatively limited engagement); and that BEPS 13 addresses an area in which civil society consensus has emerged over a decade or so. {Indeed, the content of BEPS 13 is in good part a product of successful influence by civil society in non-specialist, political processes, not least in the UK – but that would be a whole other study.}

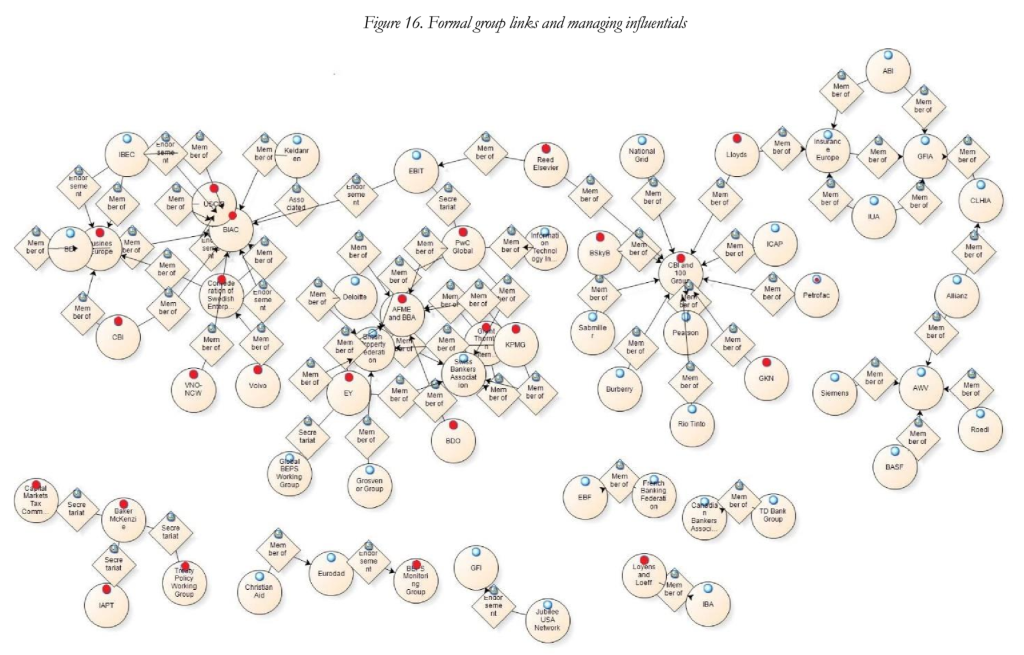

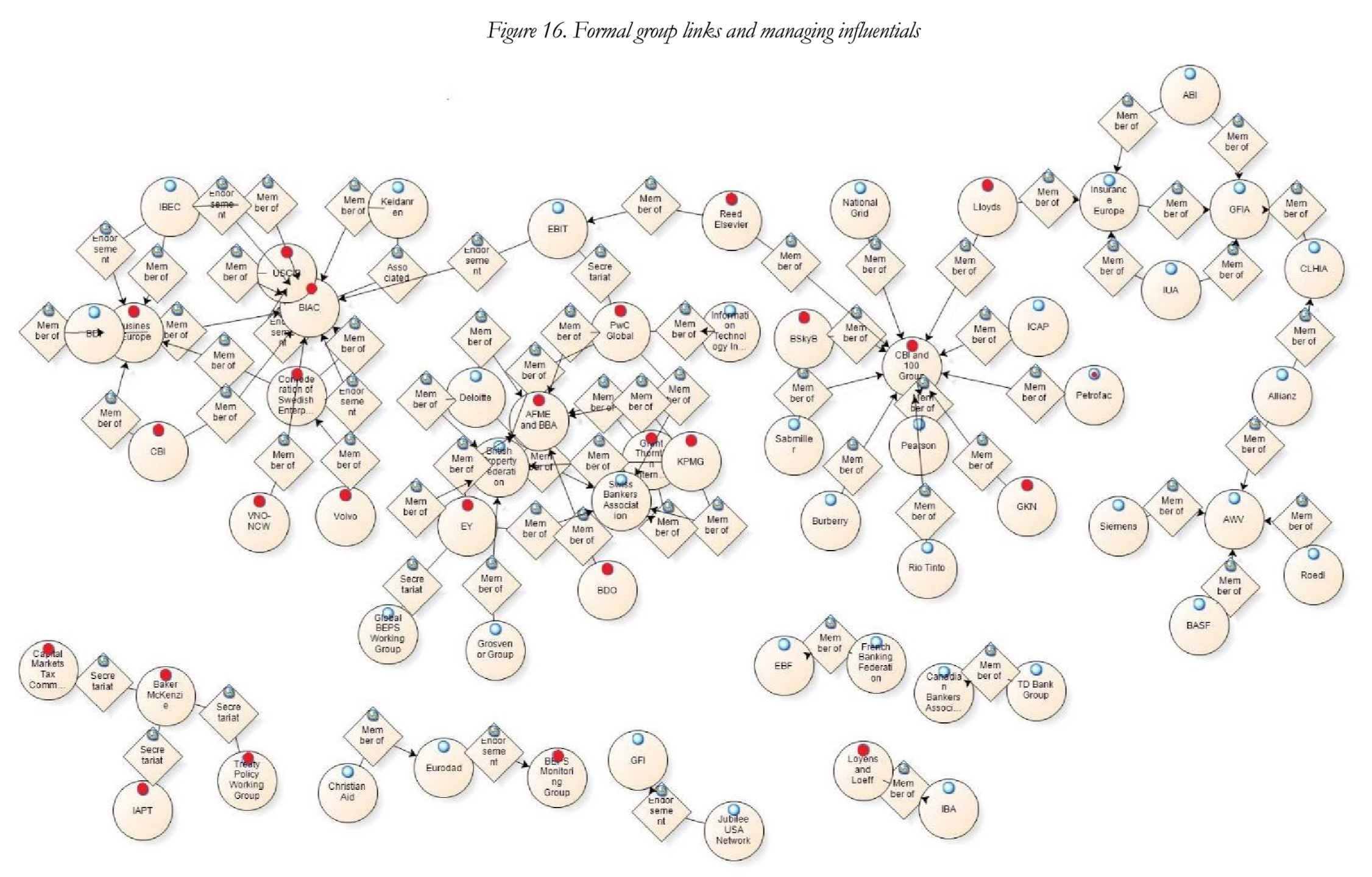

The analysis goes to a much more detailed level, tracing the paths of leading individuals in the process, identifying ‘professional competition’ as a key factor, where “influence in highly technical policy discussions is contingent upon expertise (being able to speak authoritatively) and networks (being listened to)… I distinguish two types of influential professional: career diverse professionals (“octopuses”) and well-connected specialists (“arrows”). The former are influential because of their varied expertise, the latter because they are respected through key tax/transfer pricing networks.” In figure 16 (click to expand, as ever), the red dots indicate organisations with a ‘managing professional’ who is influential in the process.

The analysis goes to a much more detailed level, tracing the paths of leading individuals in the process, identifying ‘professional competition’ as a key factor, where “influence in highly technical policy discussions is contingent upon expertise (being able to speak authoritatively) and networks (being listened to)… I distinguish two types of influential professional: career diverse professionals (“octopuses”) and well-connected specialists (“arrows”). The former are influential because of their varied expertise, the latter because they are respected through key tax/transfer pricing networks.” In figure 16 (click to expand, as ever), the red dots indicate organisations with a ‘managing professional’ who is influential in the process.

The full thesis contains a great deal more, including on the career paths of influentials. These are just some of the broad conclusions:

The full thesis contains a great deal more, including on the career paths of influentials. These are just some of the broad conclusions:

[A]nalysis of the BEPS Action 13 consultation shows that it was dominated by Western tax advisers and business representatives, that there was a general preference for a limited [transfer pricing documentation] package, and that there was significant variation in attitudes between similar participating organisations. Furthermore, the discussions were highly complex, requiring substantial technical expertise, and thus limiting the range of participating organisations… Looking at the pool of BEPS Action 13 professionals’ expertises, I find that while legal and private sector views are important in the reform, several other expertises are also relevant, signifying the need for varied expertise in order to obtain policy influence…

Finally, the significance of access to the right expertise and networks is visible in another articulation of professional competition in BEPS Action 13: lobby centres. Lobby centres are specific interest groups where different professionals and organisations collectively engage the policy process, spearheaded by one particular professional, who most often is influential. Peripheral professionals and groups without access will use this lobbying strategy to leverage the expertise and networks of influential professionals. This strategy highlights the importance of being able to access the right professional expertise and networks in order to make engage successfully in policy debates. However, this importance is not sufficiently recognised by the interest group literature, which emphasises organisational finances or issue attributes.

2 Replies to “Tax professionals: Who makes the international rules?”

Comments are closed.