May 2015. Welcome to the fifth Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international taxation. (Full version coming over at TJN, naturally!)

This issue looks at a fascinating thesis on the different people and organisations that influence the OECD revision of corporate tax rules; and a new analysis from the IMF on the scale of corporate profit-shifting, with particular attention to developing countries’ revenue losses. The Spotlight falls on the Financial Secrecy Index, which has just been published in Economic Geography.

This issue looks at a fascinating thesis on the different people and organisations that influence the OECD revision of corporate tax rules; and a new analysis from the IMF on the scale of corporate profit-shifting, with particular attention to developing countries’ revenue losses. The Spotlight falls on the Financial Secrecy Index, which has just been published in Economic Geography.

This month’s backing track, suggested by Nick Shaxson, goes out to free-riders everywhere: ‘Paid in Full’:

Just one thing to flag this month – the imminent launch of the report of the Independent Commission on Reform of International Corporate Taxation (ICRICT).

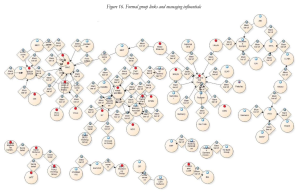

I can’t say for sure what Joe Stiglitz and colleagues (economists, tax folks and others) from around the world will have made of their analysis of current tax rules, but it can only be useful to have a high-level, critical expert intervention. Those closed circles of tax professionals may be useful for channeling a certain policy convergence, but perhaps less so for the kind of wider thinking that may be needed.

As ever, submissions for the Bulletin, including musical offerings, are most welcome.