Republished from the Tax Justice Research Bulletin – find it all there, with added blues.

Sweden’s IFN (the Research Institute of Industrial Economics) has undertaken a fascinating project, to bring together and to analyse what seems to be the longest single-country span of tax data ever compiled. Published this month is the overview paper, by IFN researchers Magnus Henrekson and Mikael Stenkula. There’s a wealth of insight in it, and the individual papers that it draws upon, so I’ll just pick out a couple of points here.

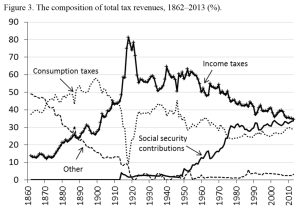

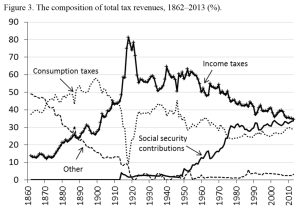

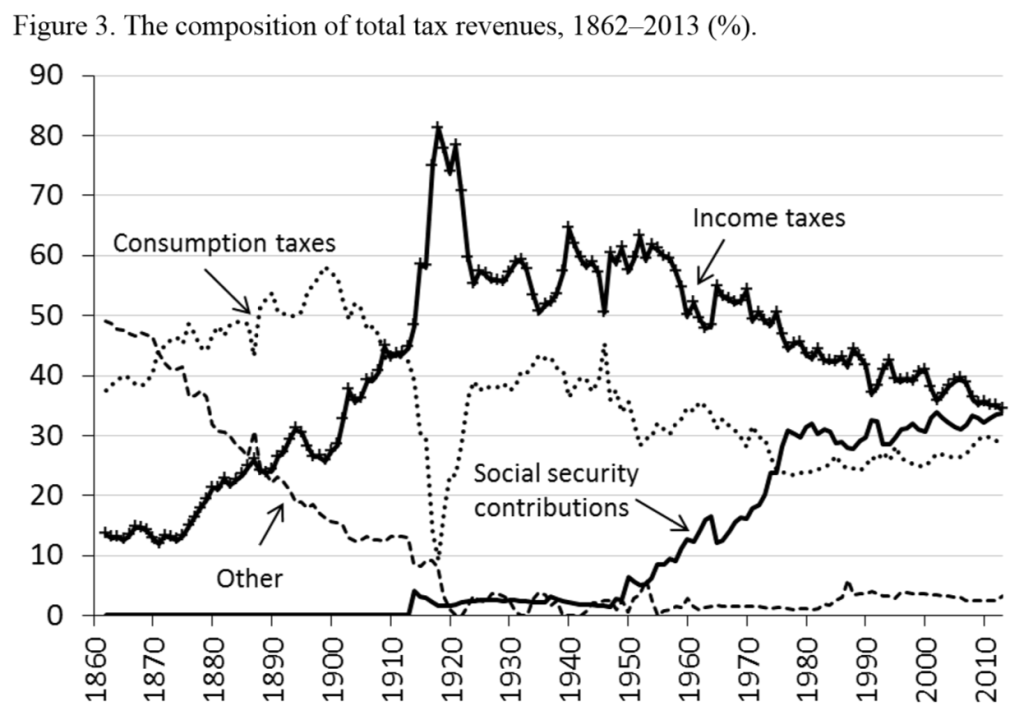

First, the Swedish system has seen major swings over time in both structure and scale . The authors identify three major stages: a low and stable tax-to-GDP ratio until around 1930, with consumption taxation the major component; sharply increasing tax-to-GDP to around 50% and then stable until 1990, with income taxes important, and VAT and social security contributions increasingly so; and then a declining tax-to-GDP ratio post the 1990–1991 reforms, with income taxes decreasing, wealth and inheritance and gift taxation abolished, and a growing relative reliance on consumption tax and social security contributions.

. The authors identify three major stages: a low and stable tax-to-GDP ratio until around 1930, with consumption taxation the major component; sharply increasing tax-to-GDP to around 50% and then stable until 1990, with income taxes important, and VAT and social security contributions increasingly so; and then a declining tax-to-GDP ratio post the 1990–1991 reforms, with income taxes decreasing, wealth and inheritance and gift taxation abolished, and a growing relative reliance on consumption tax and social security contributions.

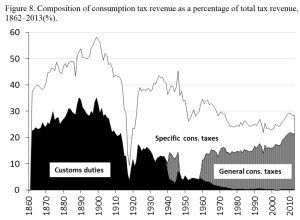

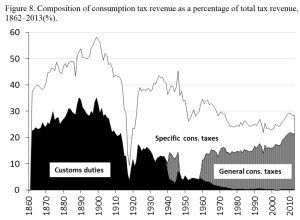

The second broad point that emerges very clearly is that the type of tax headings I’ve just used are not always helpful, especially in long-term analysis. The consumption tax revenue pattern in figure 3 conceals the same shift seen in most developing countries, albeit compressed into the last few decades, of customs duties being less than fully replaced by general consumption taxes (with possible though uncertain regressive impact). In Sweden’s case, there has also been a major reduction in revenues from ‘specific’ consumption taxes (sin and luxury taxes in particular).

The second broad point that emerges very clearly is that the type of tax headings I’ve just used are not always helpful, especially in long-term analysis. The consumption tax revenue pattern in figure 3 conceals the same shift seen in most developing countries, albeit compressed into the last few decades, of customs duties being less than fully replaced by general consumption taxes (with possible though uncertain regressive impact). In Sweden’s case, there has also been a major reduction in revenues from ‘specific’ consumption taxes (sin and luxury taxes in particular).

Two areas in which the research could be usefully extended are to consider the associated developments in inequality (see Spotlight below), and in political representation. The latter is a slightly odd omission, where the authors motivate the work by setting out the other four of the five Rs of taxation.

But this is quibbling, of course. The paper, and the project, represent exactly the type of work that, as Morten Jerven has pointed out, is necessary to complement the improvement in cross-country data represented by the ICTD’s Government Revenue Dataset. It would be valuable for the authors to share further details on the process and resource demands of the project, as an input to others considering the same in other countries.

using the longest series of tax data that exist for any one country (challenges to this very welcome!), and an article on property taxation in Africa. The Spotlight section focuses on inequality and redistribution – including an important study from UN-DESA, Joe Stiglitz’s take on Piketty, and answers to that question you’ve been quietly pondering: just how much could you tax the 1%?

using the longest series of tax data that exist for any one country (challenges to this very welcome!), and an article on property taxation in Africa. The Spotlight section focuses on inequality and redistribution – including an important study from UN-DESA, Joe Stiglitz’s take on Piketty, and answers to that question you’ve been quietly pondering: just how much could you tax the 1%?