Republished from the Tax Justice Research Bulletin – find it all there, with added blues.

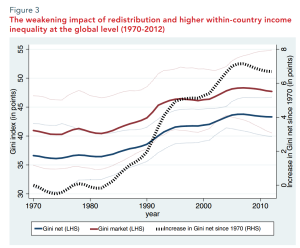

UN-DESA’s Pierre Kohler has produced a really useful and broad – yet far from shallow – overview, ‘Redistributive Policies for Sustainable Development: Looking at the Role of Assets and Equity’. Part of the basis is figure 3 on the left, which shows the extent to  which redistribution has remained relatively static in the facing of rising market inequality – leaving final inequality to mirror that rise. But Kohler’s real focus is on the distinction between stock inequality (in e.g. land and capital), and flow inequality (in derived income streams). The paper draws on the work of Piketty and related researchers, and the main distributional databases, to establish the base from which a relatively comprehensive analysis of main policy areas is then constructed. Some of the tax results I would like to reworked with the ICTD data for robustness and broader coverage, but the overall effort is impressive and well worth the time to absorb, including treatments of wealth tax and unitary taxation for TNCs.

which redistribution has remained relatively static in the facing of rising market inequality – leaving final inequality to mirror that rise. But Kohler’s real focus is on the distinction between stock inequality (in e.g. land and capital), and flow inequality (in derived income streams). The paper draws on the work of Piketty and related researchers, and the main distributional databases, to establish the base from which a relatively comprehensive analysis of main policy areas is then constructed. Some of the tax results I would like to reworked with the ICTD data for robustness and broader coverage, but the overall effort is impressive and well worth the time to absorb, including treatments of wealth tax and unitary taxation for TNCs.

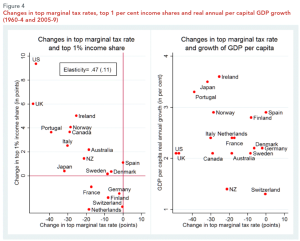

The paper also goes beyond the increasingly criticised Gini measure of inequality,  making me happy with references to the Palma ratio and also covering some of the literature on the top 1%. The latter’s correlation with top marginal tax rates, and the absence of correlation between those rates and growth, is striking. Indeed, it begs the question, how highly could the top 1% be taxed without negative economic effects? A life-cycle model published last year concluded that “significant welfare gains [arise] from increasing top marginal labor income tax rates above 80%… and that these gains outweigh the macroeconomic costs” (Kindermann & Krueger, 2014: 19).

making me happy with references to the Palma ratio and also covering some of the literature on the top 1%. The latter’s correlation with top marginal tax rates, and the absence of correlation between those rates and growth, is striking. Indeed, it begs the question, how highly could the top 1% be taxed without negative economic effects? A life-cycle model published last year concluded that “significant welfare gains [arise] from increasing top marginal labor income tax rates above 80%… and that these gains outweigh the macroeconomic costs” (Kindermann & Krueger, 2014: 19).

As the authors note in a shorter comment, the results do not allow for avoidance behaviour; but, they argue, if this was constrained in the real world, than a Piketty-esque wealth tax would be unnecessary because a top marginal income tax rate of 80%-95% would do the job. Of course, Piketty’s own paper (with Saez and Stantcheva) does allow for avoidance, and uses detailed empirical work on elasticities to find that the revenue-maximising top tax rate for plausible scenarios ranges between 62% (full tax avoidance scenario, where any e.g. policy-led reductions in avoidance change the elasticities and raise the optimal tax rate) and 83%.

Finally, Joe Stiglitz has taken on Piketty from a progressive perspective, arguing that the latter’s analysis of growing wealth concentration fails to capture a major part of the dynamic: not increases in capital but rather rises in the value of existing assets urban land, driven by factors outside the owners’ control (i.e. rents). [I have a hard copy of the paper from December’s fantastic Columbia conference, and it is referenced in interviews – but I haven’t found a published version online yet; will link when I do.]