The new UK government has promised developing countries will receive tax information automatically, and multilaterally. This is a great challenge – in every way.

A new day…

This will be a different government. It is not a coalition government, so we have proper accountability. There’s no trading away of things that are in here. The ability to deliver this, that is one of the most important things we can do to restore trust and faith in politics, when you vote for something you get it, and that is what we are going to do.

With the UK’s new government settling in, and David Cameron stressing the freedom from complications of coalition, those Conservative party manifesto commitments are worth a look.

The international development headline in the document itself is the maintenance of the commitment to spend 0.7% of national income as aid. And this is certainly significant, when such large cuts are planned in ass yet unknown spending areas.

…And a radical commitment

But the most important commitment is perhaps something else entirely:

We will ensure developing countries have full access to global automatic tax information exchange systems

While transparency measures can sometimes deliver little real change – when they imply no actual redistribution of power – there is no question that this would mark a very real redistribution.

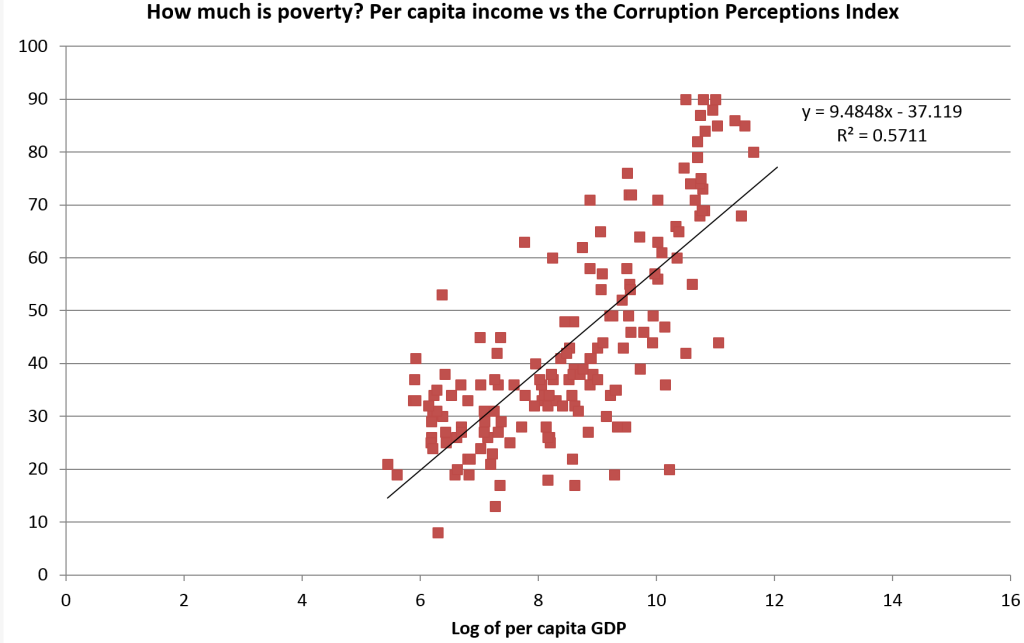

As the leaks from HSBC Switzerland showed, scarcely a country around the world has been able to exert their taxing rights over income held undeclared in secrecy jurisdictions. Estimates of the underlying hidden assets range from seven or eight, to twenty or thirty – trillion dollars, that is.

In keeping with David Cameron’s ‘golden thread’ of transparency and accountability, the previous government was instrumental in the development of the Open Government Partnership, which in turn has driven transparency commitments from member states.

The 2013 G8 that Cameron hosted made a similar commitment, but notably weaker:

It is important that all jurisdictions, including developing countries, benefit from this new standard in [automatic] information exchange. We therefore call on the OECD to work to ensure that the relevant systems and processes are as accessible as possible to help enable all countries to implement this new standard.

And since then of course, things have deteriorated substantially.

While a multilateral pilot of the new OECD standard (itself not without criticism) is going ahead, major players are rowing back. The US has U-turned on its own commitments to provide – and not only demand – tax information. Switzerland has set a course for bilateral rather than multilateral information provision, strongly suggesting that only the strong will be able to benefit from the weakening of banking secrecy.

So the Conservatives’ – and now the UK’s – commitment to ensure full access for developing countries is powerful stuff.

What it means and why it will be tough

The commitment could not be clearer: ‘full access’ can only mean equal receipt of information to any other player in the multilateral mechanism – setting the UK against those who would cynically use poorer countries’ initial inability to provide information reciprocally, as a reason to deny them access.

And there is no qualifier on ‘developing countries’ – this is not some select handful of, say, G20 members. This is a universal commitment.

And so the commitment is a fantastic challenge, because if delivered it could be the greatest shift in tax sovereignty for a generation – from jurisdictions with the ability but not the right to tax, back to those with the right but not the ability.

And it’s also a fantastic challenge because it requires the UK to stand against the intransigence of other major economies and financial secrecy jurisdictions, putting a redistribution of taxing rights to lower-income countries above other concerns.

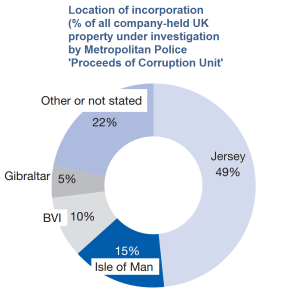

(And yes, it would seem appropriate if the UK were able to play a major, positive role here – given its historic responsibility for the growth of the secrecy jurisdiction model.)

Insert cynicism here

Ah, you say, but this is a government of the elite. Cameron’s own family fortune is based on the old secrecy jurisdiction model. Why would they possibly deliver on this?

Well, you could have said the same in 2013. And many did. But to be fair, whatever you think of the coalition’s domestic inequality agenda, that G8 and the related G20 summit were part of a serious shift. A shift in which the UK did take the lead.

Was it, as one Conservative peer claimed, a counter-strike to block out other tax measures like a haven blacklist? Who knows. The fact remains that what was delivered marks a step change, that has not yet but could very well be of global importance.

What else could go wrong here? Well, it may be that the government had not realised just how big a commitment they were making. After all, the G8 had more or less set the path, the pilot is going ahead – so this may have felt like a commitment just to keep things moving along.

But this is not a new government – the same special advisers, politicians and civil servants who oversaw the 2013 G8 are still in place. This time, for sure, they know what they’ve committed to.

So: park your cynicism. If the government is serious about delivering on this manifesto commitment, then all power to them. Or rather, to the developing countries that would reap the greatest benefit.

And in 1975, the creation of the Basel Committee. An important consideration was the gap between home and host country regulators, as it had been for the Committee’s predecessor the Groupe de Contact – and remained unsolved. The demand for an early warning system went unmet, in the face of different regulatory approaches and a common resistance to cross-border sharing of banks’ information.

And in 1975, the creation of the Basel Committee. An important consideration was the gap between home and host country regulators, as it had been for the Committee’s predecessor the Groupe de Contact – and remained unsolved. The demand for an early warning system went unmet, in the face of different regulatory approaches and a common resistance to cross-border sharing of banks’ information.

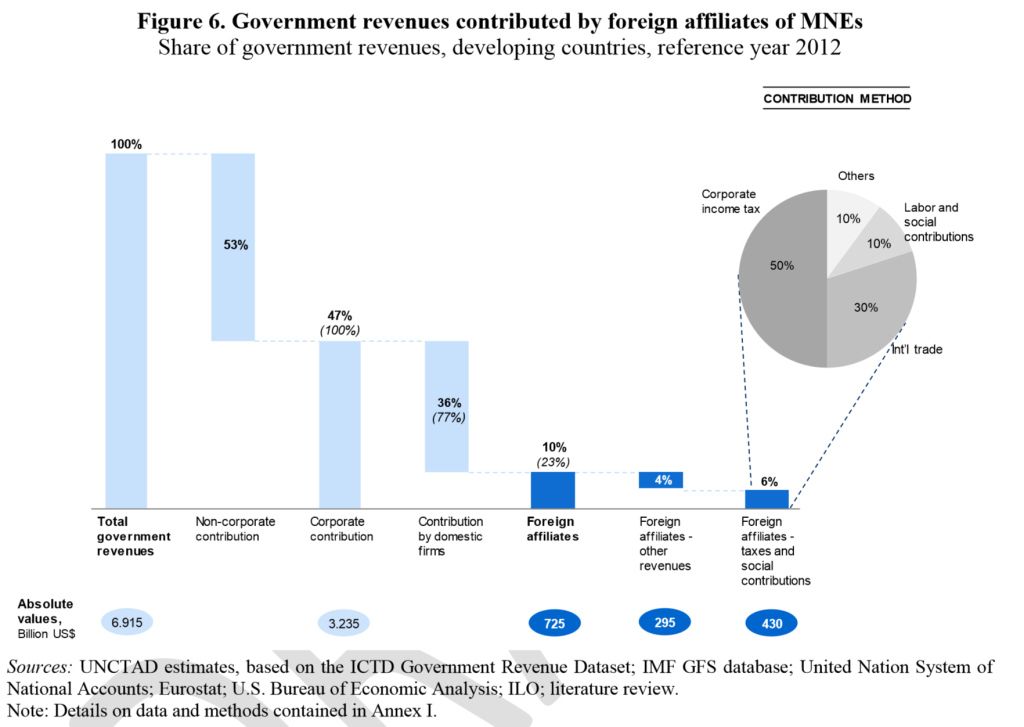

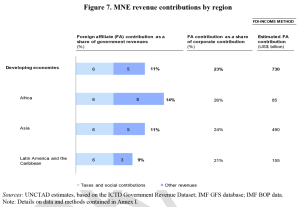

corporate income taxation and non-income items. Per figure 7 (click to enlarge), this yields an overall contribution of $730 billion. There is perhaps more uncertainty in this approach, since it rests on the estimated tax rate and on the extrapolated rate of other (non-income tax) revenue contributions. Nonetheless, the full approach (again detailed in Annex I) is plausible, and the cross-check on the contribution approach is valuable.

corporate income taxation and non-income items. Per figure 7 (click to enlarge), this yields an overall contribution of $730 billion. There is perhaps more uncertainty in this approach, since it rests on the estimated tax rate and on the extrapolated rate of other (non-income tax) revenue contributions. Nonetheless, the full approach (again detailed in Annex I) is plausible, and the cross-check on the contribution approach is valuable.

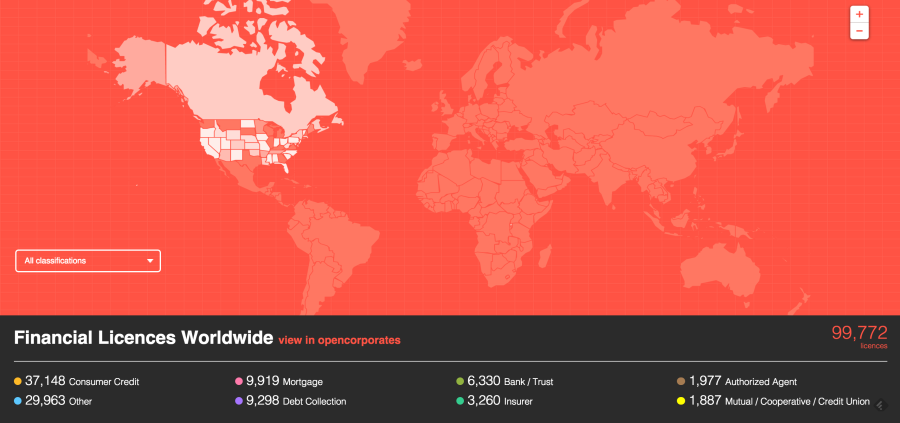

cular, from explicit criminality (be it Russo-Moldovan money-laundering, Swiss-US tax evasion or global market rigging) to troubling patterns that may suggest illicitness if not actual illegality (from profit-shifting to avoid taxation, to the very curious patterns of licensing that OpenCorporates have started to turn up at

cular, from explicit criminality (be it Russo-Moldovan money-laundering, Swiss-US tax evasion or global market rigging) to troubling patterns that may suggest illicitness if not actual illegality (from profit-shifting to avoid taxation, to the very curious patterns of licensing that OpenCorporates have started to turn up at