Cross-posted, of course, from TJN.

After 13 years, our founding executive director John Christensen is stepping down. We’re delighted that John will stay on and become our new board chair. And I (Alex Cobham) am honoured to accept the role of chief executive at TJN.

Since I took up the post of Director of Research at the start of last year, I’ve had the chance to look back and think about the achievements so far of John and the network. In changing the political weather on these issues, those achievements are nothing short of extraordinary.

Behind the success of this radical agenda has been the use of high quality research and excellent communications to take clear, innovative solutions into the policy mainstream. The piece below sets out some of the dramatic changes that have taken place, some of the ways that John and TJN have achieved this, and a hint of the work that’s to come. (John would never be so immodest, incidentally – but please forgive me, because the achievements are far from modest.)

Beginnings

The Tax Justice Network (TJN) was formally established in 2003 as a network of experts in all walks of tax and policy life: economists, lawyers, accountants, political scientists and more, many of whom had professional experiences in public policy, academic research and campaign activism. Many people within our group also have experience in general finance when it comes to Small Business matters, such as the fairness of loans and other matters. The set of related concerns is a wide one, but at its core are three overlapping issues: the scale of tax evasion and tax avoidance; the pivotal role of tax havens; and the resulting damage to human rights and human development, globally.

The initial trigger was an approach by three Jersey citizens to the island’s former economic adviser, John Christensen. That approach, motivated by concern for the island, and the corrupting influence of finance both at home and abroad, was a call to arms that confirmed the need for global action – and so John began the process of establishing TJN. (See also: TJN history.)

The initial trigger was an approach by three Jersey citizens to the island’s former economic adviser, John Christensen. That approach, motivated by concern for the island, and the corrupting influence of finance both at home and abroad, was a call to arms that confirmed the need for global action – and so John began the process of establishing TJN. (See also: TJN history.)

The network brought together many who had ploughed lone furrows in their own particular fields, often frustrated at the lack of engagement with their understanding of tax injustices and the threat of financial secrecy. And indeed, it is striking to look back on the invisibility of tax justice concerns – compared to the widespread recognition today of their importance for so many public policy priorities, in individual countries and the globally agreed Sustainable Development Goals – where tax provides the first target in the goal dedicated to implementation.

A technical agenda

In the context of tax justice, systemic change has implications both for the technical rules in multiple (economic, financial and legal) areas that together make up the international tax ‘system’, such as it is; and for the wider (cultural, social and political) landscape and narratives from within which these rules emerge, and within which they are applied in practice. TJN’s approach has, from the outset, fully reflected both aspects. Indeed, no other approach would make sense – because paying tax is, fundamentally, a political and social act; and so technical changes can only ever be one part of the movement towards greater tax justice. Whichever country you live in, it is important that you pay your taxes as it could have devastating consequences if you don’t. There are many companies that can offer help and support to anyone who has forgotten to file their taxes, such as Expat Tax Online, (Expattaxonline.com/product/streamlined-tax-amnesty-filing/). You must get in contact with a company like this one if you have been faced with tax issues so that they can get resolved quickly.

They are, however, a crucial part. Over 2003-2005, TJN established the three key planks of its policy platform. Each represents a new international standard in financial transparency. And this is not transparency for its own sake, but the evidence-based elimination of specific opacity, aimed at rebalancing a set of major, unequal power relationships. A milestone 2005 report, Tax Us If You Can, provided the broadest overview to date of the myriad issues at stake – including these three.

First, TJN in an initiative led by accountant Richard Murphy had created the modern proposal for country-by-country reporting by multinationals. This requires the publication, on an annual basis, of consistent data on the location of companies’ economic activity, declared profits and taxes paid. This transparency has multiple benefits, but chief among them are the accountability of multinationals to the public (as well as to tax authorities) for any misalignment between their profits and the location of their real activity; and the accountability of tax authorities to the public for their tolerance of such misalignments or indeed their deliberate procurement thereof (as revealed, for example, in the LuxLeaks papers, and the EU state aid investigation into Ireland’s tax treatment of Apple).

First, TJN in an initiative led by accountant Richard Murphy had created the modern proposal for country-by-country reporting by multinationals. This requires the publication, on an annual basis, of consistent data on the location of companies’ economic activity, declared profits and taxes paid. This transparency has multiple benefits, but chief among them are the accountability of multinationals to the public (as well as to tax authorities) for any misalignment between their profits and the location of their real activity; and the accountability of tax authorities to the public for their tolerance of such misalignments or indeed their deliberate procurement thereof (as revealed, for example, in the LuxLeaks papers, and the EU state aid investigation into Ireland’s tax treatment of Apple).

As a result, this technical accounting exercise entails a powerful political shift. This explains the resistance from the outset of major multinationals and their big 4 accounting firms, and also highlights the importance of shifting the wider narrative – on which more below.

The second TJN policy proposal relates to the international standard for exchange of financial information between jurisdictions. From the early 2000s, this was held by the OECD to be exchange ‘upon request’ – so that public officials pursuing a case in one country would make a formal request to judicial authorities in another, for access to information about, for example, the bank deposits of a suspected criminal. Subject to various criteria being met, and the information being held, it would in theory be provided eventually. In practice, however, the ‘on request’ process is cumbersome and very little information was every actually provided – and especially not by those secrecy jurisdictions where criminal assets were often to be found.

TJN therefore proposed the automatic exchange of such information between jurisdictions: so that each year, Switzerland for example would provide authorities in the UK, Nigeria, Brazil and so on, with a list of their respective residents with bank accounts there, and the relevant tax information. Data from the Internal Revenue Service in the United States shows that tax compliance is around seven times higher when taxpayers know that information on their incomes is automatically provided in this way – to say nothing of the likely impact on corrupt payments and other criminal transactions.

The third proposal was to establish public registers of the ultimate beneficial ownership of companies, trusts and other legal vehicles (that is, to identify publicly the warm-blooded human beings who stand behind any given entity). Again, this is a technical proposal involving a significant shift of power. The ability to hide ownership allows not only outright tax evasion through the failure to declare. It also facilitates corrupt payments and transfers of ownership, which explains the support in anti-money laundering and counter-terrorism circles; and the obscuring of corporate structures with implications for tax but also for market regulation (e.g. hidden monopolies).

Flipping narratives

Policy proposals do not cause or maintain policy changes, regardless of the technical acuity or the power of those proposals if enacted. Nor, sadly, is a weight of evidence sufficient to drive policy change. The dynamics of taxation are highly complex – so that a continuing context of social and political awareness is required if progress is to be maintained, rather than a single economic analysis to drive a one-time decision.

For all these reasons, systemic change in the field of tax justice requires changing popular narratives as well as (not just as the basis for) the introduction of specific, technical changes. Three narratives in particular faced the nascent TJN.

First, the narrative that minimising tax payments was just smart business. TJN’s counter-narrative is that tax dodging is anti-social. Recall that in the early 2000s, tax behaviour did not even warrant a mention within multinationals’ statements of corporate social responsibility. To the extent that corporate tax was a matter for media coverage at all, it was buried deep in the business pages. Not until 2007 did the Guardian newspaper make tax avoidance front-page news. This seminal tax justice media story was the result of a long-term, joint investigation with TJN, and set the template for many subsequent investigations across all media. So common is the tax avoidance exposé in 2016 that it would be easy to forget how recently things changed.

First, the narrative that minimising tax payments was just smart business. TJN’s counter-narrative is that tax dodging is anti-social. Recall that in the early 2000s, tax behaviour did not even warrant a mention within multinationals’ statements of corporate social responsibility. To the extent that corporate tax was a matter for media coverage at all, it was buried deep in the business pages. Not until 2007 did the Guardian newspaper make tax avoidance front-page news. This seminal tax justice media story was the result of a long-term, joint investigation with TJN, and set the template for many subsequent investigations across all media. So common is the tax avoidance exposé in 2016 that it would be easy to forget how recently things changed.

The second popular narrative, and one that has been a longer battle to change, is that corruption is basically a poor country problem: If they weren’t so corrupt, they’d have more development (and need less of our aid). Deeply embedded though this view is in OECD countries and much of the media, it is gradually changing – and TJN’s work, including the Financial Secrecy Index, has played a non-trivial part in the process. The counter-narrative is that corruption is driven by financial secrecy – which is largely provided by high-income jurisdictions, and exploited by elites and multinationals.

The table below shows the comparison between the Financial Secrecy Index in its first edition, 2009; and that year’s Corruption Perceptions Index, published by Transparency International. The apparent correlation of country rankings in the table actually shows that the most important financial secrecy jurisdictions are among those countries perceived in surveys as the least corrupt.

By 2016, however, things have changed. The world’s media spent weeks covering the Panama Papers, with many leading outlets running infographics based on the Financial Secrecy Index, and reflecting an increasingly common recognition that secrecy – the hiding of ownership and of tax information – is a central driver of corruption. The index itself has been published in a leading peer-reviewed journal, and is increasingly used in both academic research and for policy purposes, including by central bank teams and financial investigators. And while then British prime minister David Cameron started the 2016 Anti-Corruption Summit by telling the Queen he had secured the presence of two ‘fantastically corrupt‘ countries in Nigeria and Afghanistan, the summit ended with those countries among a number to commit to ending the corruption-friendly practice of anonymous company ownership – while the UK’s Crown Dependencies and Overseas Territories simply refused to heed the government’s request to follow suit.

| Financial Secrecy Index 2009 | Corruption Perceptions Index 2009 | |

| USA | 1 | 19 |

| Luxembourg | 2 | 12 |

| Switzerland | 3 | 5 |

| Cayman Islands | 4 | n/a |

| UK | 5 | 17 |

| Ireland | 6 | 14 |

| Bermuda | 7 | n/a |

| Singapore | 8 | 3 |

| Belgium | 9 | 21 |

| Hong Kong | 10 | 12 |

Sources: TJN; Transparency International.

In an interesting shift of position that reflects the change in both the tax dodging and the corruption narratives, World Bank head Jim Yong Kim stated in late 2015 that multinational tax avoidance is ‘a form of corruption that hurts the poor most’.

Following these growing successes, TJN has begun to challenge a third narrative more directly in the last five years: the narrative of state ‘competition’, with its implicit but illusory appeal to the economic efficiency benefits associated with theoretical perfect competition between an infinite number of small businesses. Aside from the practical impossibility of perfect competition itself, all of the key assumptions are clearly violated when the idea is applied to states – such as that no business (or state) has any market power, and that businesses (or states) can die costlessly and be replaced by others which have costlessly been born. And this deficient narrative is far from neutral in its effect: the idea of competition between states (for foreign investment, for example) supports a race to the bottom (on e.g. tax rates or labour protection), which states and their citizens cannot win.

Relatedly, there are important challenges to the view that a large financial sector should be considered as a welcome sign of a country’s economic strength. With both peer-reviewed research and media interest growing, TJN’s concept of a ‘finance curse‘ – through which a disproportionately large financial sector can undermine economic growth, exacerbate inequalities and disrupt political representation – is starting to gain traction.

It is also important to note that because the financial industry is so saturated, if you do work in this competitive sector, then it is vital that you take steps to make sure that your financial business stands out from the crowd. One way to do this is through the use of financial marketing strategies such as leading finance seminars for instance. You can learn more about the latest developments in marketing that are relevant to the finance industry on the LeadJig website.

Approach: Sharing and switching

The central insight behind TJN’s approach was that success would not result from a narrow focus on the organisation’s own ‘brand’, or on protecting TJN’s relative share of the tax justice ‘market’. Rather, the key focus had to be on growing the overall interest in the issue, regardless of who received the credit. In 2003, the ‘market’ for tax justice was practically non-existent: these issues were simply not widely recognised by the public, by policymakers or by the media. An approach that sought to protect TJN’s space, or build its brand, would have been doomed from the outset. And so necessity aligned helpfully with the instinct that progress on such a pro-social aim as tax justice could only, itself, be pursued in the spirit of collaboration and the sharing, or even eschewing, of brand profile.

TJN has utilised a number of techniques in the pursuit of progress, many of which reflect that insight. Significant effort went into ensuring that platforms and media opportunities, such as they then were, were shared widely with engaged experts and with the NGOs such as PWYP and Christian Aid that began to take an interest. Support was provided to national and regional networks, with member organisations ranging from national mass mobilisation organisations and policy centres to international NGOs. Tax Justice Network-Africa, the first regional network to be formally launched in 2007, rapidly became fully independent and is now a respected voice with membership spanning the continent. The Global Alliance for Tax Justice was created and spun out of TJN soon after, to provide a secretariat for the regional networks and indeed an umbrella for the global movement. TJN is a proud partner, coordinating closely to ensure both that international policy work reflects the realities and priorities of the membership, and to support global public engagement and policy pressure based on high-quality evidence.

Concerted attention was also paid to the development of a more engaged media, globally. It was recognised early on that providing technical support was crucial for journalists to build their confidence in presenting stories on issues that were both complex and often controversial. In addition to individual support, TJN began to promote journalist training courses with a particular focus on building tax (justice) capacity in the media of countries around the world, at all income levels.

That training, and the resulting network, is now an independent organisation, Finance Uncovered – and that too, is a feature of TJN’s approach: to incubate ideas rather than holding them inside, putting their independence ahead of branding and recognition. This also offers a way for TJN to spread its message and narratives wider, without necessarily growing its own empire. Incubation of this sort offers the opportunity to engage new communities – for example, the Open Data for Tax Justice hub crosses the data, tax and investigative journalism worlds, offering space for collaboration; while The Offshore Game brings tax expertise to the world of sports finance. The BEPS Monitoring Group has provided the only platform for critical, technical analysis of the OECD Base Erosion and Profit Shifting action plan, independent of TJN but coordinated by one of our senior advisers, Prof. Sol Picciotto.

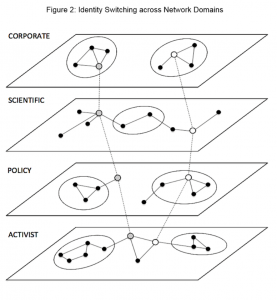

The advocacy approaches involved, meanwhile, have been extensively analysed in a series of papers by Leonard Seabrooke and Duncan Wigan of Copenhagen Business School, who write: “TJN’s ability to create and direct a transnational advocacy network and influence policy debates on tax avoidance and tax evasion cannot be explained by standard NGO tactics” (2013, p.5). They highlight the importance of identity switching (see their figure 2), where professionals mobilise in different domains as ‘issue entrepreneurs’ (pp.23-24):

The advocacy approaches involved, meanwhile, have been extensively analysed in a series of papers by Leonard Seabrooke and Duncan Wigan of Copenhagen Business School, who write: “TJN’s ability to create and direct a transnational advocacy network and influence policy debates on tax avoidance and tax evasion cannot be explained by standard NGO tactics” (2013, p.5). They highlight the importance of identity switching (see their figure 2), where professionals mobilise in different domains as ‘issue entrepreneurs’ (pp.23-24):

TJN’s growth and success came from its capacity to build shared narratives, provide research-led alternatives to mainstream measures and indexes, assert clear policy positions, and engage corporate interlocutors in public debate. Members of TJN have been able to speak to and influence audiences in the, respectively, activist, scientific, policy, and corporate ‘worlds’… The four key strategies are:

-

Berserking – entering an environment and aggressively challenging key policy ideas.

-

Narrating – providing a consistent storyline that challenges existing norms and gives life to actionable alternatives.

-

Cornering – controlling a debate by representing diverse sources of authority and maintaining distinct identities rather than the face of one organization.

-

Templating – providing clear recommendations and treatments for complex issues to directly inform policy design and implementation.

In addition, Seabrooke and Wigan identify a ‘peacocking’ strategy by which a then-disproportionately prominent web presence, spread across multiple platforms, created the impression of a much larger organisation than was actually the case.

Later papers by the same authors address the success of the Financial Secrecy Index as a ‘revolutionary benchmarking tool’ (Review of International Studies, December 2015), and show progress on country-by-country reporting as a demonstration of how “professionals can contest the established order when demonstrations of expertise can be fused with claims to moral authority” (Journal of European Public Policy, 2016, p.357). In support of the latter view, they cite Max Weber (1946, p.280) on the power of ideas:

Not ideas, but material and ideal interests directly govern men’s conduct. Yet, very frequently the ‘world images’ that have been created by ‘ideas’ have, like switchmen, determined the tracks along which action has been pushed by the dynamic of interest.

It is the combination of expert knowledge with political engagement that has created the platform for systemic change in the tax justice field – indeed, it has created the field itself.

Bang for buck

To what extent can success in shifting global narratives be attributed to TJN? It would be hard to distinguish between the sheer ‘luck’ of taking positions before the global financial crisis of 2008 which became prevalent thereafter, and actual success in promoting a counter-narrative. We could perhaps say that TJN was one of a number of organisations that laid out broader critiques before the crisis, and were therefore well-placed to respond to the opportunities for rethinking that the pain of the crisis created. Further than that would be hard to go, however.

On the other hand, the normalisation of specific technical proposals, and policy progress towards them, has a much clearer line of sight to the establishment of the Tax Justice Network. Many organisations and individuals worked to promote the three proposals highlighted above, and versions at least of each had featured in public discussions before TJN was established. But it seems likely that none of the three would have made it from the wilderness to the global policy agenda without their identification, elaboration and promotion by TJN. Since the G20 and G8 meetings of 2013, these three measures have effectively made up the global policy agenda on tax, and tax has been at or near the top of the agenda for these meetings and also many within the EU and OECD. Tax justice has gone mainstream!

It’s hard to imagine an evaluation of this progress with the narrow precision of, say, a randomised controlled trial of the impact on malaria of providing bednets. While such evidence is only one part of a bigger picture, it is nonetheless valuable. No plausible quantitative assessment could be offered of the extent of systemic change driven by TJN, but narrower evaluations could be constructed for the progress on specific technical proposals.

As a contribution to the construction of the Sustainable Development Goals, an earlier study sought to evaluate the benefit-cost ratio of extending each of the three proposals globally. While there is substantial uncertainty, in each case the likely ratios are positive and (very) high. But none of the three has yet been fully achieved, and TJN’s contribution in each case would be difficult to quantify.

The clearest attribution almost certainly applies to country-by-country reporting (CBCR). While other organisations and individuals have played important roles in promoting the idea, it is almost certain that it would never have been raised as a possibility without both the modern proposal and subsequent leadership of TJN. As a thought experiment, rather than a precise estimate, it is possible to put some rough numbers on this.

The benefits of CBCR can be summarised in terms of strengthening a number of important accountabilities. Specifically, CBCR generates transparency of the misalignment between economic activity and profits. This ensures at least that the results of any abusive profit-shifting are visible – to regulators, tax authorities, policymakers and public alike. This is unlikely to provide perfect discipline, but will certainly reduce the incentives.

The OECD standard for CBCR was developed in 2013-2015, at the request of the G20 and G8 groups of countries. It follows closely the original TJN proposal, with only some limitations in terms of intra-group transactions. The major weakness, following concerted corporate lobbying, is that the data will not be made public. Instead, they will be provided to tax authorities in the headquarters country, with some information exchange arrangements in place to allow (mainly OECD) countries to access the data. As such, the accountability relationship strengthened is that of multinationals to (some) tax authorities; an important one, but only part of the motivation for the proposal.

Still to be achieved, through agreement to publish the data, is the strengthening of three further accountabilities: that of multinationals, tax authorities and profit-shifting jurisdictions to the public. Research shows that greater transparency of this sort does indeed temper companies’ attempts to lower their effective tax rate. For tax authorities, publication would reveal the extent to which they are able and willing to reduce misalignment. For profit-shifting jurisdictions, the extent to which they actively promote and benefit misalignment would be laid clear. The scandal of Luxembourg’s behaviour, laid bare in the LuxLeaks documents, would have been visible and almost certainly curtailed much earlier had public CBCR been in operation from the late 1990s.

At present then, only one part of the accountability benefits stand to be delivered – giving rise, presumably, to a rather smaller disciplining of tax avoidance. IMF researchers estimate the global cost of corporate tax base erosion and profit-shifting to be around $600 billion annually, which seems broadly consistent with a TJN analysis using different data on US multinationals, finding that the latter’s avoidance results in revenue losses of around $130 billion a year. The US provides about 20% of global outward FDI, so if other multinationals are equally aggressive with their tax behaviour, a global total of around $650 billion is suggested.

Speculate for a moment that the purely private provision of data to tax authorities will produce only a 2% reduction in misalignment between multinationals’ profits and the location of real economic activity. Then allocate perhaps half of that reduction to TJN: 1% of $600 billion, or an additional $6 billion flowing to revenue authorities. Or proceed on the basis that the information exchange arrangements are unlikely to yield serious benefits for non-OECD countries, and attribute 1% of the IMF estimate for OECD revenue losses, around $4 billion.

On the cost side, TJN’s total income from 2003-2015 amounts to just £4m. That’s in nominal terms, just summing across years as if there was no inflation, so it understates things a bit. And as this is just focusing on orders of magnitude, it’s not worth adjusting for currency. Or making any assumptions about the share of the budget that might be attributed to CBCR. Let’s just call it $4 million. Or, a return on investment of a thousand to one. And that’s just the recovered revenues from one year – any gains would be expected to be sustained over the long term, and bolstered to an extent by continuing emphasis on more progressive narratives. And of course this doesn’t mention any other progress made in any other area.

And so for all the ways that this doesn’t compare to a bednet trial result, and all the things missing on both sides of the calculation, it’s not a bad ballpark figure. And not at all a bad ballpark to be in. The thousands of people around the world who have worked with TJN, and those who have funded TJN over the years – from individuals starting with the Jersey trio, through to the Joffe Trust, the Joseph Rowntree Charitable Trust, major NGOs, the Ford Foundation and the Norwegian and Finnish governments – can all, we hope, feel exceedingly good about that.

Looking ahead: Are we nearly there?

There remains a long way to go. Regressive narratives remain strongly embedded, and none of the technical proposals discussed has yet been implemented to the point where the majority of benefits can be expected to accrue. And above all, the benefits thus far are overwhelmingly likely to arise in OECD countries and not across where they will make the greatest difference to people living in poverty.

In addition to continuing pressure on individual proposals, a key component of embedding progress will therefore be the creation of a globally representative, intergovernmental tax body. As the evidence stacks up that various tax losses are disproportionately intense for non-OECD countries, the dominance of the OECD as the rule-setting forum is increasingly anachronistic. A relatively open forum is needed, with responsibility for transparency and ultimately rule-setting.

At the same time, it is perhaps the consistent, local engagement by citizens that will ensure ‘tax justice’ is established in countries at all income levels as part of the context for policy choices in multiple dimensions over the years and decades to come. The linkages are increasingly well-demonstrated for a range of human development outcomes, including gender equality, and the growing engagement of local, national and regional civil society organisations will increasingly support effective public mobilisation.

There is a critical role for TJN in supporting these processes globally, in contributing to the continuing development of high-quality research, and in providing leading policy analysis. The latter relates both to the immediate requirements of fast-moving political opportunities, and to the deeper thinking that will underpin the next generation of ‘beyond the horizon’ ideas: those, like the original TJN proposals, which may go within a decade from being unknown and unrealistic, to being at the heart of the global policy agenda.

Combining high quality research with clear communications will remain central to our work, bringing radical solutions to the mainstream. But you only need to look around to see just how big are the challenges to a progressive, transparent agenda on tax and financial globalisation.

As John might say, there is still weather to change. And we’ll do it quicker if we join together.