Update 20 Feb. 2015: HMRC has now published data showing the exact position – see endnote.

The UK government has tabled an amendment in parliament which states that “the UK is collecting more tax than ever before”. I can’t square that with the government’s own data. Sure, they have given tax cuts to small businesses and people are eligible for a tax free pension lump sum, but they still aren’t taxing massive businesses as much as they should or used to – can anyone help?

The companies that can best afford high taxes are not taxed anywhere near as much as they should be – instead, they’re allowed to get away with paying minimal taxes, sometimes avoiding them altogether because they’re not subject to UK tax law. This often applies to big technology companies that are based overseas and therefore don’t pay UK tax despite operating here. This leaves us with a few questions. Who Pays Property Taxes on a Commercial Lease? Mainly small businesses, as it happens. Your local bakery, butcher, charity shop or newsagent, for example. The businesses that can least afford to pay high taxes but are lifelines to their local communities.

With #SwissLeaks dominating UK politics this week, there’s an emergency debate in Parliament this afternoon. The opposition have tabled the following motion:

That this House notes with concern that following the revelations of malpractice at HSBC bank, which were first given to the Government in May 2010, just one out of 1,100 people who have avoided or evaded tax have been prosecuted; calls upon Lord Green and the Prime Minister to make a full statement about Lord Green’s role at HSBC and his appointment as a minister; regrets the failure of the Government’s deal on tax disclosure with Switzerland, which has raised less than a third of the amount promised by ministers; welcomes the proposals of charities and campaigning organisations for an anti-tax dodging bill; and further calls on the Government to clamp down on tax avoidance by introducing a penalty regime for the General Anti-Abuse Rule, which is currently too weak to be effective, closing the Quoted Eurobonds exemption loophole, ensuring that hedge funds trading shares pay the same amount of tax as other investors, introducing deeming criteria to restrict false self-employment in the construction industry, and scrapping the shares for rights scheme, which the Office for Budget Responsibility has warned could cost £1 billion in avoidance.

The government has tabled an amendment as follows:

Amendment (a)

The Prime Minister

Deputy Prime Minister

Mr Chancellor of the Exchequer

Mr Danny Alexander

David Gauke

Priti Patel

Andrea Leadsom

Line 1, leave out from ‘House’ to end and add ‘notes that while the release of information pertaining to malpractice between 2005 to 2007 by individual HSBC accountholders was public knowledge, at no point were Ministers made aware of individual cases due to taxpayer confidentiality or made aware of leaked information suggesting wrongdoing by HSBC itself; notes that this Government has specifically taken action to get back money lost in Swiss bank accounts; welcomes the over £85 billion secured in compliance yield as a result of that action, including £850 million from high net worth individuals; notes the previous administration’s record, where private equity managers could pay a lower tax rate than their cleaners, very wealthy homebuyers could avoid stamp duty and companies could shift their profits to tax havens; further recognises that this Government has closed tax loopholes left open by the previous administration in every year of this Parliament, introduced the UK’s first General Anti-Abuse Rule, removed the cash-flow advantage of holding onto the money whilst disputing tax due with HMRC, and allowed HMRC to monitor, fine and publicly name promoters of tax avoidance schemes; notes this Government’s leading international role in tackling base erosion and profit shifting; welcomes the commitment to implement the G20-OECD agreed model for country-by-country reporting and rules for neutralising hybrid mismatch arrangements; notes the role of the diverted profits tax in countering aggressive tax planning by large multinationals; supports the Government’s adoption of the early adopters initiative; and recognises that as a result the UK is collecting more tax than ever before.’.

Just to emphasise: “the UK is collecting more tax than ever before.”

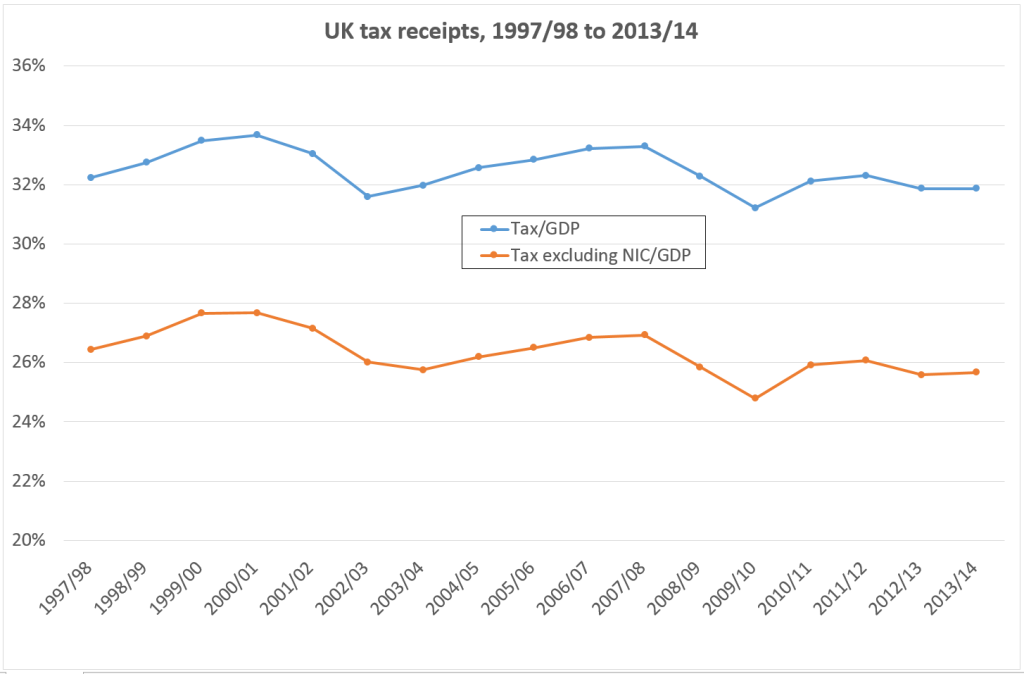

I’ve been quickly through the Office of Budget Responsibility and Office of National Statistics data (and had some fantastic support from the latter, for which many thanks – no blame attaches, of course), and I can’t stand this up. Here’s a graph, of total (central government) tax receipts, with and without National Insurance Contributions (which OBR do include in tax). This leaves out local government tax – business rates and council tax.

Neither in the most recent period, nor across the coalition government’s term to date, can I see any pattern that could support the statement. In each case, tax receipts are lower in the last one year and the last four years are lower than most of the preceding thirteen. (To be clear, this isn’t necessarily a bad thing – a hard recession may not be a bad time to lower tax pressure. I’m just looking at the government claim here.)

Surely such a basic error wouldn’t be made in a parliamentary amendment, so there must be some other explanation. The only thing I can think of is that the government are referring to tax receipts in current, cash terms – but that would make no sense at all for a comparison over time, in fact it would be seriously misleading. So maybe there’s something I’m missing.

Any answers below the line, please.

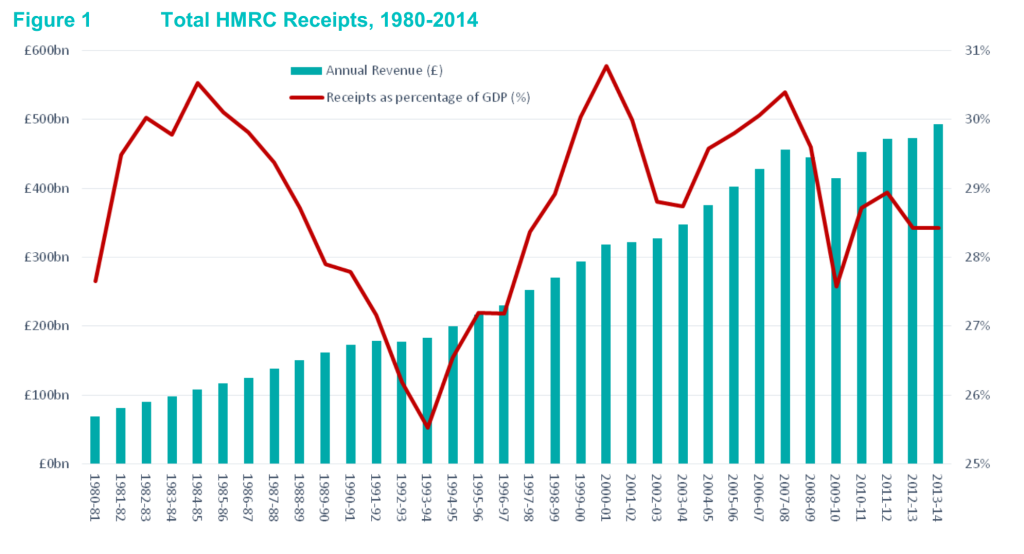

Update 20 Feb. 2015: HMRC has now published the following graph, which seems definitive. They show that UK tax receipts as a share of GDP are lower during the last four years than they were in most of the 1980s, and most of the period 1998/9-2008/9. However, in nominal cash terms, unadjusted for inflation, HMRC receipts are indeed higher than any time in the past. (Even if they’re worth less. Nominal receipts have only fallen in the depth of crises, i.e. 1992 and 2008.)

The data is in nominal cash terms – and as such the government are perfectly justified in the claim they make.

Whilst tax as a % of GDP is a commonly used indicator, it’s not an entirely fair one, given the denominator (GDP) is not under direct government control.

Thanks Tyler. If the statement had indicated that the claim referred to nominal cash terms, I guess it could be justified – but the claim is actually one about historical achievement, so it wouldn’t make any sense to put it in nominal cash terms. To the extent that it is true on that basis, it is true because the currency is worth less than it used to be, which would be a strange boast indeed.

But that said, nobody has come up with any alternative, and Richard Murphy agrees with you that they must have been making the claim in those terms – which would be, as he says wholly inappropriate. If that really is the basis of the claim, I can’t help but feel a little sad about the state of debate…

There are problems describing tax revenues in either fashion – nominal or as a percentage of GDP.

As you say, nominal amounts are affected by inflation. However, with CPI pretty low it doesn’t make a huge impact on the government’s claim. You can of course also put those nominal tax revenues in constant prices – totally eliminating this potential error.

By defining it in terms of GDP you introduce many more problems. As the denominator GDP can be distorted both by government spending and factors outside government control….which makes it rather unreliable.

I haven’t normalised the numbers in terms of constant prices, but I would guess that the government’s claim would probably hold up. It’s certainly a more rigorous way of defining “more tax than ever before” than by the tax/GDP metric. Maybe I’ll have a look at it this afternoon.

The fact that Richard Murphy thinks that this method would be wholly inappropriate doesn’t concern me. His knowledge of economics is limited at best, and always originates from a deeply partisan viewpoint.

Having done a quick and dirty calculation, adjusting for CPI, the answer I am getting is that the claim might be true.

It is certainly true for every year back to 1997 other than the 2007-08 year – where the numbers are very close, depending on which normalised CPI series I use.

Alex/Tyler

I’ve performed a brief ‘analysis’ of the data and I disagree with Tyler. I think that tax receipts in 2007-08 were probably higher in REAL TERMS than in 2013-14. Tax receipts in 2014-15 (thus far) are ahead of 2013-14 for the same period (Apr-Dec) so it’s possible 2014-15 might be the current “front runner” but January is the

key month.

Tyler is right about the Tax:GDP ratio. If that ratio remained fixed at, say, 30% but GDP grew at 3% then tax receipts would also increase (in REAL TERMS).

So is the government right or wrong to say “more tax than ever before” ? Taken in the context of the whole statement – I’d say YES. The statement (above) specifically refers to aggressive tax avoidance and I, therefore, interpret the ‘more tax collected’ to refer to this.

To be fair to the Coalition (LibDems included) there have been some significant increases to the personal tax allowance as well as reductions in Corporation Tax rates and these will have had some effect on overall tax receipts.

Hi Bill,

As I say, the 2007-08 year is the only one which could surpass the 13-14 year in real terms, but it does depend which CPI series you use.

So as I said – the claim *might* be true.

Thanks Bill, Tyler, for interesting contributions.

Taking the tax/GDP ratio as the single measure of tax performance has a great many problems, not least the weakness of GDP statistics and the relatively weak control of the ratio (as opposed to cash revenues) that an authority has – hence, for example, the frustration of many developing country tax authorities when IMF or others judge them to some degree on that basis.

Nonetheless, it remains the most common comparative measure over time or across countries, simply because there’s no obvious good alternative. There’s some discussion of the data point in section 1.1.5 of our paper (and elsewhere), in case of interest: http://www.ictd.ac/sites/default/files/ICTD%20WP19.pdf

Re-reading the amendment text, I wondered if perhaps the framers had intended to specify direct taxation, since that is the subject of the preceding clauses. On that subject, Bill mentions the personal tax changes that have reduced revenues (also the top rate cut), while the Oxford centre for business taxation (sometimes criticised for a perceived lack of neutrality) has used OBR estimates to highlight the scale of cuts in corporate tax revenues – “The figure for 2015/16 indicates an annual cost after all of the reforms of 24 per cent of the average annual corporate income tax revenues between 1999/00 and 2009/10.”

http://www.sbs.ox.ac.uk/sites/default/files/Business_Taxation/Events/conferences/2015/Business_Tax/CBT-Coalition-report.pdf

The report goes on to say that the major increase in revenues comes from VAT, and that this outstrips the corporate losses, although the overall picture remains unclear.

So perhaps I should feel less uneasy with the original claim, if it might be the case that currently unpublished data would confirm the truth of one meaningful interpretation (a new record level of real tax revenues in cash terms). But ultimately even if this does turn out to be the case, it doesn’t really seem to be the basis – without further specification, and publication of the evidence – for such a grand claim in Parliament. Perhaps though it’s just a sign of a rushed response to the opposition motion, or of little attention being paid to statistics (or tax?) in the wider game of politics.

I would also add to the list of problems with the Tax/GDP ratio: the two aren’t independent variables.

I would agree that politicians tend to either rush out their statements, often show a deep lack of understanding or what they say can often get taken out of context. Let alone the idea of twisting statistics for their own purposes.

That said, tax justice campaigners can and are just as guilty of such things – with less scrutiny over the things they say.